-

What we do

-

Why Clarilis

Why leading law firms and businesses choose Clarilis

-

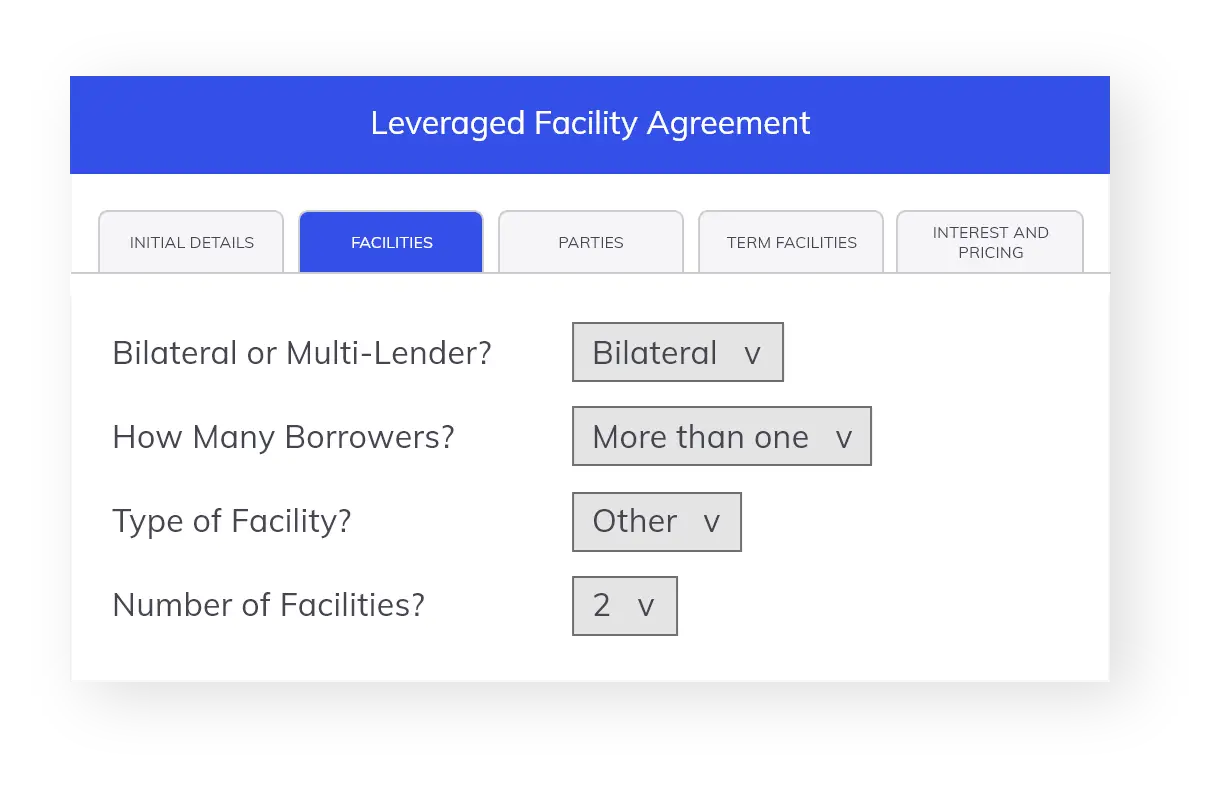

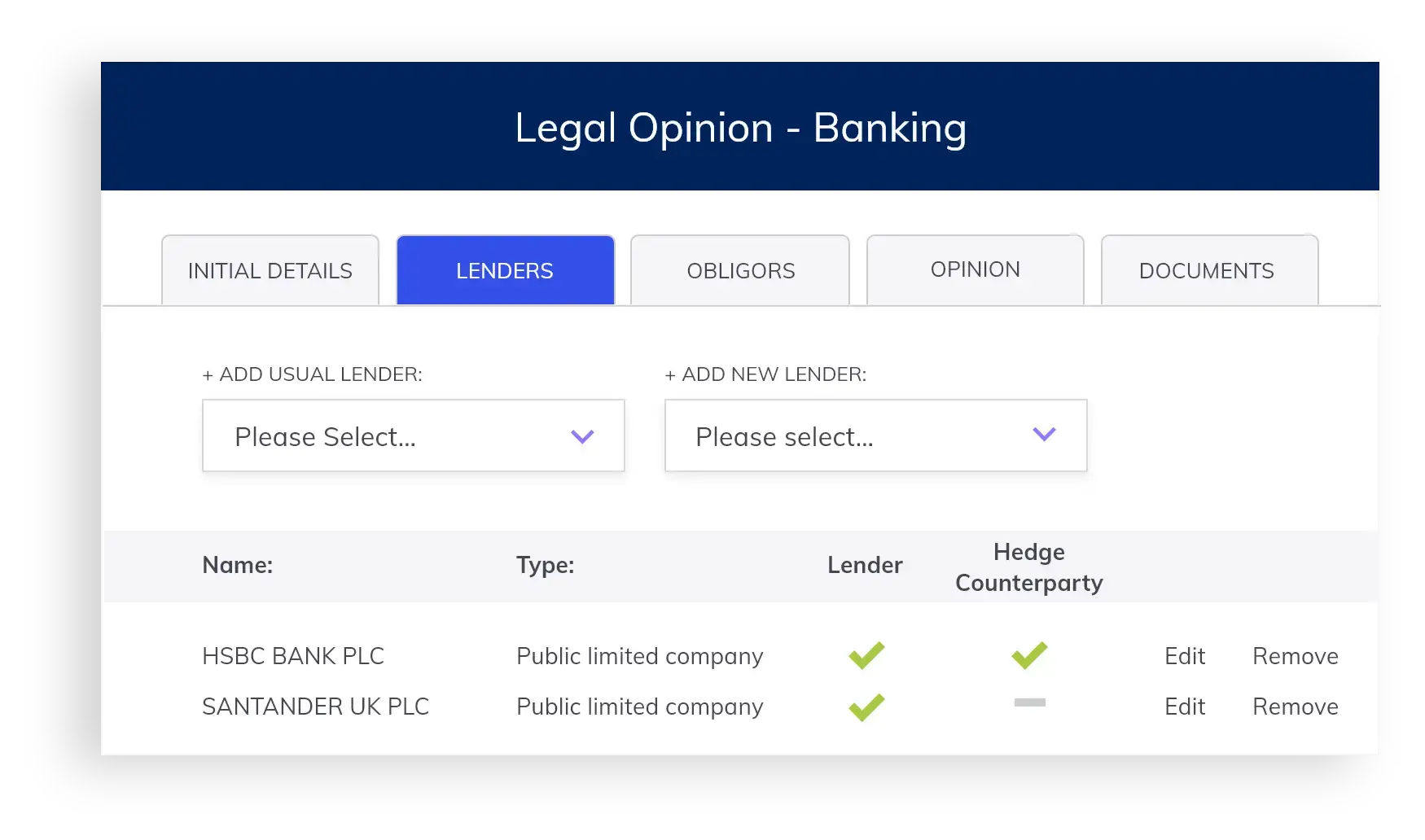

Platform

Draft suites of documents 90% faster

-

Security

Enterprise-level GDPR-compliant security

-

AI Draft

Leverage the power of LLMs to enhance your drafting experience

-

Managed Service

Delivering outcomes to transform your legal practice

-

Partners

FromCounsel, MCL, TLT, PwC, your firm

-

Working Globally

Trusted by leading law firms and organisations

-

Why Clarilis

- Solutions

- Customers

- About us

- Resources

.jpg)